Yeoh Siew Hoon

BANGKOK -- Thailand is expected to attract an estimated 36.1 million tourists this year, compared with the 39.9 million it received in 2019, with a full recovery projected by 2025.

And if you haven't visited here lately, you will probably be amazed by the changes in Thailand's capital city.

The global preoccupation with wellness and well-being and the local legalization of marijuana means you'll see as many wellness centers and weed joints as street stalls in this chaotic, bustling city that never ceases to impress foreign visitors with its juxtapositions of traditions and modernity.

I had just emerged from the RAKxa Integrative Wellness Retreat in Bang Krachao, known as the Green Lung of Bangkok, where I had seen an alternative medicine therapist who had recommended a series of treatments -- which mainly involved me lying down and being subjected to the most soothing and healing of treatments over three days.

And from RAKxa, I was headed to the Movenpick BDMS Wellness Resort Bangkok. This is an Accor-managed hotel owned by BDMS Wellness Centre, the preventive-medicine arm of a leading hospital, Bangkok Hospital, that is opening wellness centers across the country.

It was there that I met with Benoit Racle and Jean-Yves Minet, a day after they were introduced as the new global brand presidents for Accor's premium, midscale and economy brands. Both were being introduced to Accor's Middle East, Africa and Asia-Pacific commercial teams gathered in Bangkok.

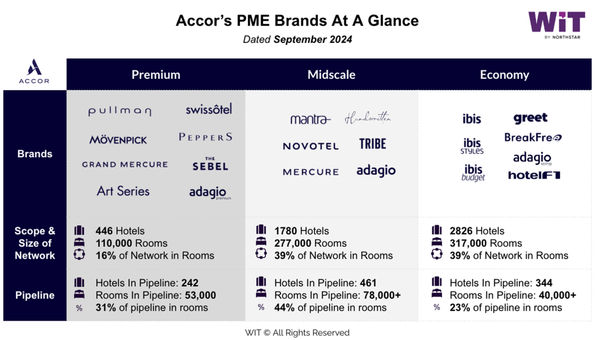

Racle is heading premium, including the Pullman, Swissotel, Movenpick, Angsana and Peppers brands. Minet is heading midscale and economy, including Novotel, Mercure, Tribe, Handwritten Collection, Ibis, Ibis Styles and Ibis Budget and Greet.

A deluxe suite bedroom at the Movenpick BDMS Wellness Resort Bangkok. Photo Credit: Courtesy of Accor

The move to Accor

Minet comes to Accor after spending the past 14 years with the Estee Lauder Companies, leading its $8.5 billion international division. I asked him why he chose to leave beauty and cosmetics for hospitality.

"I have always been interested in travel. I spent six years in travel retail -- all the products we sell in duty free -- and have always looked at travel corridors and consumer tastes," he said.

"There are a lot of opportunities in travel that seduce me. It is one of the few where demand exceeds offer, although it is very competitive," he added. "There is growing access of emerging consumers to wealth in markets such as China, Turkey and India. There is the rise of the middle class; traveling is the No. 1 desire for the emerging consumer. Growth is almost guaranteed. It's how you can exceed that is most interesting."

Racle, on the other hand, started in hospitality when he was 15, working in the front office of a small hotel, and later honing his skills with Starwood and W. "I've been a chef, security, general manager. Having a guest smiling and happy is what drives my life. I will never leave the industry."

He was drawn by the culture of Accor and how it takes care of people. "Covid broke my heart," he said. "We had to stop working with a lot of people. In North America, we lost about 45% of the workforce. Accor demonstrated that it took care of people, and now we have to bring back the people to the industry."

Due to their dissimilar backgrounds, the two men had different introductions to their new roles.

Racle spent a month on the road, visiting his brands' teams and properties across the world. "I wanted to understand the culture, what does it mean to work with Accor for teams and owners -- to understand the nuances of each market. It was exhausting but refreshing at this point in my career to listen.

"The second priority is to ask, what is our five-year plan? Building brands takes time; it's a long-term vision."

For his own "induction," Minet spent time in-hotel, working in the kitchen, cleaning rooms, manning the front desk. "I learned the business, trying to understand the flow of the hotel, how it works, how we then translate the value proposition of each brand to the experience. How can we constantly innovate to bring something new to the consumer, solidifying the fundamentals and investing in the future? What will Ibis look like 20 years from now -- we should be asking that now." (The Ibis brand, described as "vibrant, casual, friendly," encompasses 1,278 hotels and 158,793 rooms).

The focus on consumers

For both executives, it's not about how many brands each has to manage but about being consumer-centric all the time.

"Consumers are looking for experiences; travel is all about experiences," Minet said. "With beauty, it's a physical product. The big difference is whether you add an experience, pre- or post-purchase; and with the plethora of physical products, what makes the difference is when a brand creates an emotional connection through an experience.

"The answer is always in the consumer: knowing him or her better," he continued. "In beauty, we did product development through research. Each year, we launched 10 to 15 new products, with different levels of innovation: packaging, new formula, refined storytelling. I'd like to take that knowledge to hospitality. What does it mean -- sampling, for instance -- to hospitality?"

For Racle, his goal is "to make sure our brands have a point of view, what we want to stand for."

With W, he had one brand to focus on and built a very clear positioning for the Marriott-operated brand. He acknowledged the challenges of creating singular positioning for eight different brands.

"We have to build brands with one consumer in mind, built for that specific person. There is nothing worse than an undifferentiated brand. Could we move from location-based to brand-based, so that people would travel a bit farther to stay with a brand they love?"

In many ways, this would play well into the diversification of tourism that's badly needed in some destinations. What's the role of hotel companies to move development away from prime locations to more remote areas, which may not make financial sense from a real estate perspective?

"Well, guests are asking for that," Racle said. "Take me somewhere I haven't been, where there are fewer people, where I can have a purpose and impact."

This generational change in consumer behavior will have impact on hotel retailing and distribution. I asked Minet what hospitality could learn from the beauty trade in this regard.

"Accor is also very good at retailing, a significant part of its business is web direct. The beauty (pun intended) of the hospitality industry is, it can really go multichannel, just like beauty. There is not one consumer buying in one place. The only difference is, in beauty, the product is the same, especially on the premium end. In travel, it's all delivered through the local experience. A Mercure, which is about 'delivering local,' will be different in Indonesia versus Italy.

"There is a growing desire by brands to grow their direct channel because that enables you to establish that direct connection with the customer and build on the relationship."

Racle added, "That's the brand promise. If you book direct with us, we give you the best rate, we know you, we recognize you. That's our commitment."

That's where loyalty comes in, he said. "Consumers are looking for larger loyalty programs, which is why hotel groups are creating brands within the ecosystem. Our job is to house consumers at different stages of their lives, so we can grow with the consumer."

Photo Credit: Web in Travel

Which brand excites?

Asked which of their brands excite them most, Minet said, "I don't know them all intimately yet, but Novotel, the mothership brand of Accor, has the most heritage. It embodies what hospitality is all about. It has strong DNA, financial power and equity to cater to travelers."

He also called out Greet, a "locally engaged, collective, circular hospitality" brand, present mostly in France, with 36 hotels and 2,499 rooms. Greet is also in Austria and Germany and opening in Brussels soon.

"It is for a very specific consumer, a very interesting positioning, using recycled materials, including the bed and furniture; and its staff are 'second life' -- from marginalized communities," Minet added. "There's a social component there, and it has a lot of potential. A lot of people who care about how they consume."

For Racle, who's a believer "in the intersection of luxury, hotels, fashion and arts converging to give life to unique experiences," it's Pullman, with roots in the 1900s and described as "pioneering, transformative," with 157 hotels and 44,624 rooms worldwide.

"We are reshaping the brand to make it more socially open for culture-savvy travelers. It has the best of iconic hospitality with social spaces and incredible programming. I saw the first new Pullman in Sao Paulo, and I am excited about where this brand could go."